Jan 8, 2026 : Norway oil and gas output will fall towards 2030

Norway's oil and gas regulator says output will fall towards 2030 - Reuters

Sumitomo’s energy arm may set up LNG trading desk in Singapore - Bloomberg

The UAE’s $150 Billion Gas Bet Could Upend Global LNG Markets - OilPrice.com

Glenfarne and Donlin Gold Sign Letter of Intent for Alaska Gas and Infrastructure - Press Release

Equinor awards $10 billion in supplier maintenance contracts - Reuters

Trump says US oversight of Venezuela could last years - Reuters

How B.C. LNG projects could benefit from referral to federal major projects office - Vancouver Sun

Shell flags chemicals and products unit loss, raising doubts over $3.5 billion buyback - Reuters

DET Increases Contribution to Security of Supply by More Than One Third - Press Release

Shell fourth quarter 2025 update note - Press Release

Honeywell Modular Coil Wound Heat Exchanger Technology To Accelerate Production At Commonwealth LNG Facility - Press Release

Withdrawing the United States from International Organizations, Conventions, and Treaties that Are Contrary to the Interests of the United States - The White House

FACT SHEET: President Trump is Restoring Prosperity, Safety and Security for the United States and Venezuela - U.S. Department of Energy

Chinese villagers shiver in winter as gas subsidies phased out - Bloomberg

Trump Team Works Up Sweeping Plan to Control Venezuelan Oil for Years to Come - The Wall Street Journal (Subscription)

Lake Charles LNG Project Still Alive With Talks for Potential Sale Said Advancing - Natural Gas Intelligence (Subscription)

Prospects Dim for U.S. LNG Projects Left Behind in 2025, but Some Still Close to Reaching FID - Natural Gas Intelligence (Subscription)

Europe is struggling to kick its Russian LNG habit, researchers warn - TradeWinds (Subscription)

Peru LNG sent four cargoes in December - LNG Prime (Subscription)

Trump Says U.S. Oversight of Venezuela Could Last for Years - The New York Times (Subscription)

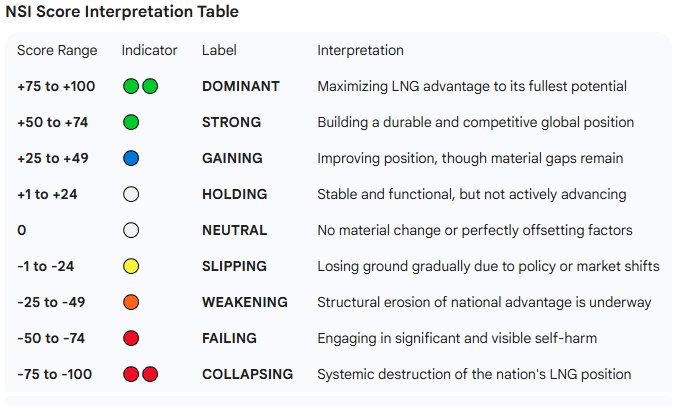

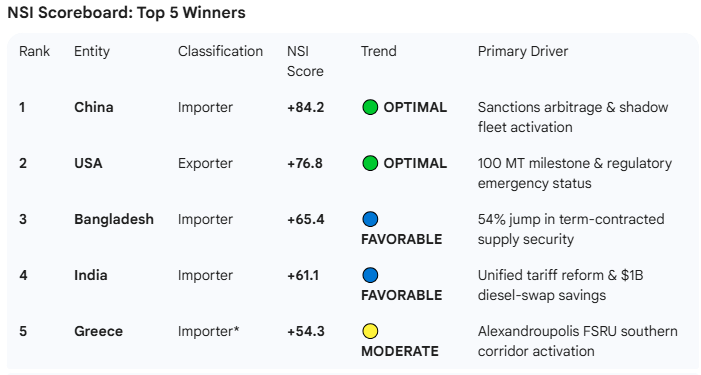

National Self-Interest Scoreboard : Weekly Self-Interest Winners Report

Report Period: December 28, 2025 – January 4, 2026

This assessment ranks the top entities that effectively converted market volatility and geopolitical shifts into durable national advantage. Under the National Self-Interest Scoreboard NSI framework, "winners" are those that maximized supply security, captured asymmetric economic value, or achieved superior infrastructure positioning.

*Classified as Importer/Transit Hub.

Winner Profiles

1. China (+84.2) — 🟢 OPTIMAL

China has executed the week’s most aggressive strategic performance by operationalizing a bifurcated import infrastructure to exploit sanctioned molecules.

- Economic Value (+30 Bonus): China imported 22 sanctioned Russian cargoes in 2025 (21 from Arctic LNG 2) at estimated discounts of 33% (one-third) relative to spot prices.

- Strategic Leverage (+20): Operationalized a 15-vessel shadow fleet and dedicated a specific terminal (Beihai) to absorb sanctioned volumes, insulating its primary commercial fleet and terminals from US/EU regulatory pressure.

- Supply Security (+15): Reversed 10 months of year-on-year import declines by pivoting to equity-backed Russian flows that Western buyers cannot touch.

- Read This :Reuters

- Read This :OilPrice.com

2. USA (+76.8) — 🟢 OPTIMAL

The U.S. has achieved structural dominance through record-breaking infrastructure utilization and a fundamental shift in executive policy.

- Infrastructure (+25): Crossed the 100 million metric ton annual export milestone in 2025, establishing a 20 MTPA lead over Qatar.

- Policy Coherence (+20 Bonus): The declaration of a national energy emergency and the removal of the LNG permit pause have de-risked the 2026-2030 buildout, with capacity projected to reach 140 MTPA by end-2026.

- Strategic Leverage (+15): Capturing 78% of December 2025 volumes into Europe, the U.S. has successfully reoriented Atlantic Basin dependency toward U.S. Gulf Coast (USGC) molecules.

- Read This :Reuters

- Read This :OilPrice.com

- Read This :The Globe and Mail

3. Bangladesh (+65.4) — 🔵 FAVORABLE

Bangladesh is executing a critical de-risking of its energy sector by aggressively moving away from spot market exposure.

- Supply Security (+25): Increased long-term contracted imports by 53.57% for 2026 (86 cargoes).

- Strategic Leverage (+15): Successfully reduced spot market reliance from 45% in 2025 to 15% in 2026. This rebalancing shields the national budget from the price shocks seen in 2022-2024.

- Economic Value (+10): Reallocated 150 mmcfd from inefficient power plants to high-value industrial sectors, prioritizing GDP growth over subsidized residential power.

- Read This :The Financial Express

4. India (+61.1) — 🔵 FAVORABLE

India is leveraging regulatory reform to drive domestic demand and capture industrial cost savings.

- Economic Value (+20): Identified a structural opportunity to save $1 billion annually in crude imports by replacing 10% of diesel transport with LNG, offering a cost advantage of ₹528 per MMBtu.

- Policy Coherence (+15 Bonus): The Petroleum and Natural Gas Regulatory Board (PNGRB) implemented a unified pipeline tariff effective Jan 1, 2026, consolidating three zones into two and reducing transmission costs by "thousands of crores" annually.

- Infrastructure (+10): Demand growth of 3-4% in FY27 is being anchored by industrial recovery and city gas distribution (CGD) expansion.

- Read This :Business Standard

- Read This :The Financial Express

- Read This :Economic Times

5. Greece (+54.3) — 🟡 MODERATE

Greece has operationalized its role as a regional gatekeeper for Southeast Europe.

- Strategic Leverage (+20): Operationalized the Alexandroupolis FSRU, establishing a new southern supply corridor that independentizes Bulgaria and the Balkans from Russian pipeline dependency.

- Infrastructure (+15): Metlen Energy & Metals now controls 35% of combined Greek-Bulgarian demand, converting infrastructure into a platform for regional commercial leverage.

- Read This :Upstream Online

- Read This :Greek Reporter

Strategic Summary

The week of December 28, 2025 – January 4, 2026 confirms that China is winning the "Commercial War" by bypassing sanctions to lower its marginal cost of supply, while the USA is winning the "Infrastructure War" by establishing an insurmountable capacity lead. Bangladesh and India are the primary "Pragmatic Winners," using the current buyers' market to fix structural flaws in their procurement and transmission models.