LNG Canada Reaches Final Investment Decision

LNG Canada today announced that its joint venture participants – Shell (40%), PETRONAS (25%), PetroChina (15%), Mitsubishi Corporation (15%) and KOGAS (5%) have taken a Final Investment Decision (FID) to build the LNG Canada export facility in Kitimat, British Columbia. Each joint venture participant will be responsible for providing its own natural gas supply and will individually offtake and market its own LNG. The FID is for two trains with the first LNG expected before the middle of the next decade. The project will initially have an estimated capacity of 14 million tonnes per annum (mtpa), with the potential to expand to four trains in the future.

The LNG Canada plant will be constructed under a single EPC lump-sum contract. Current estimated cost of the project is $31 Billion USD. Today’s announcement by LNG Canada represents the single largest private sector investment project in Canadian history.

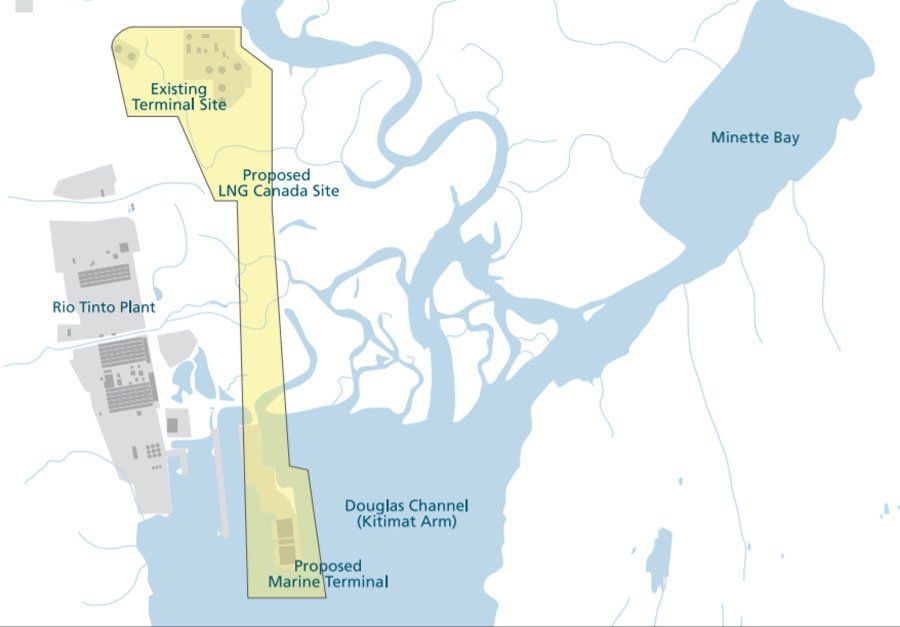

TransCanada Corporation will build, own and operate the 670-km Coastal GasLink (CGL) pipeline that will connect natural gas from northeastern British Columbia to the export plant in Kitimat. The LNG plant and CGL pipeline will together employ approximately 10,000 people at peak construction with up to 900 people at the plant during the operations of the first phase. The joint venture of JGC-Fluor Corporation has been selected as the project’s engineering, procurement and construction (EPC) contractor.

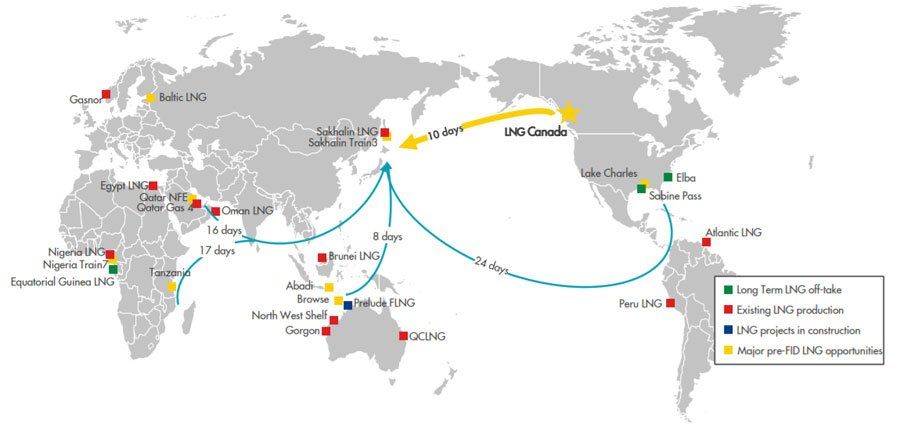

“We believe LNG Canada is the right project, in the right place, at the right time,” said Ben van Beurden, Chief Executive Officer, Royal Dutch Shell. “Supplying natural gas over the coming decades will be critical as the world transitions to a lower carbon energy system. Global LNG demand is expected to double by 2035 compared with today, with much of this growth coming from Asia where gas displaces coal. LNG Canada is well positioned to help Shell meet the growing needs of customers at a time when we see an LNG supply shortage in our outlook. With significant integration advantages from the upstream through to trading, LNG Canada is expected to deliver Shell an integrated internal rate of return of some 13%, while the cash flow it generates is expected to be significant, long life and resilient.”

The LNG Canada Plant will be constructed on a large, partially-developed industrial site with existing deep-water port, roads, rail and power supplies.

- Western Canada gas resource is estimated to contain ~300 tcf at a cost sub $3/MMBtu.

- Shell’s Groundbirch Montney assets could provide equity gas directly to LNG Canada

- Shell working interest over 9 tcf with cost of supply ~$2/MMBtu

- Flexibility to optimise feed gas cost by procuring from AECO or producing from own fields

Receive the most important LNG headlines in your email inbox each business day. Just sign up for our FREE LNG Headline Daily Newsletter.

Sign Up Here.