U.S. EIA Short-Term Energy Outlook - LNG and Natural Gas

EIA forecasts U.S. LNG exports will ramp up in the second half of 2019 to an average of 5.5 Bcf/d.

Yesterday the U.S. Energy Information Administration (EIA) released the Short-Term Energy Outlook (STEO). This edition of the Short-Term Energy Outlook is the first to include forecasts for 2019.

EIA projected U.S. LNG gross exports will average 3.0 Bcf/d

in 2018, up from 1.9 Bcf/d in 2017. In 2018, U.S. liquefaction capacity will

continue to expand. EIA expects the Cove Point terminal in Maryland to ramp up

to full capacity in 2018. At the Elba Island facility in Georgia, 6 of the 10

small modular trains, each with a capacity of 0.03 Bcf/d, are expected to enter

service this year. The first liquefaction train (capacity 0.7 Bcf/d) at

Freeport LNG in Texas is also expected to come online by the end of 2018.

EIA projects gross LNG exports to average 4.8 Bcf/d in 2019, when the four

remaining modular trains at Elba Island come online and the remaining two

trains at Freeport LNG enter service. Two trains in Corpus Christi, Texas, and

three trains at Cameron LNG in Louisiana are also expected to enter service in

2019. EIA forecasts exports will ramp up in the second half of 2019 to an

average of 5.5 Bcf/d, up from 4.1 Bcf/d in the first half of 2019.

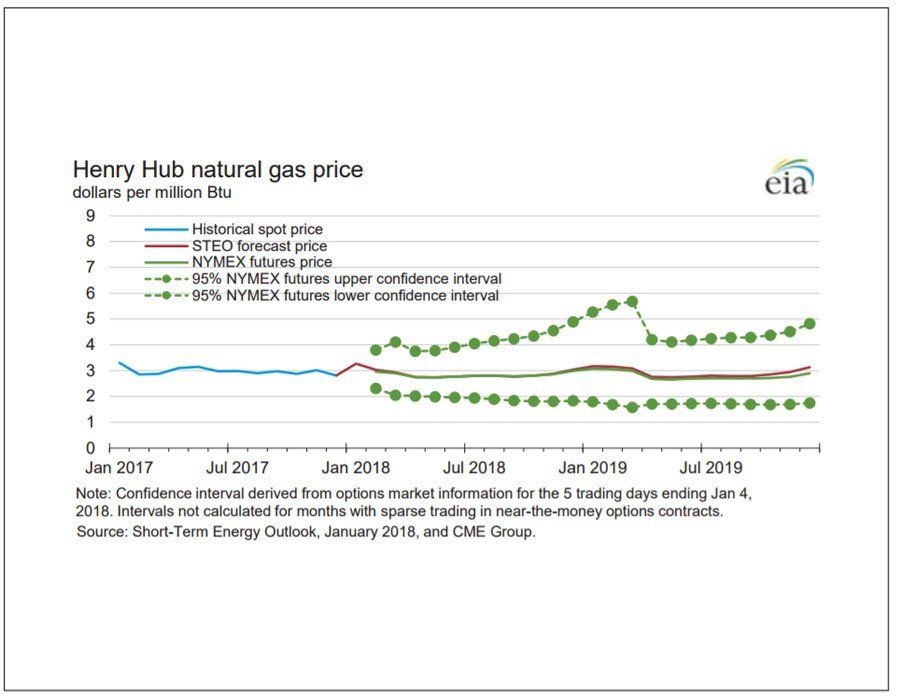

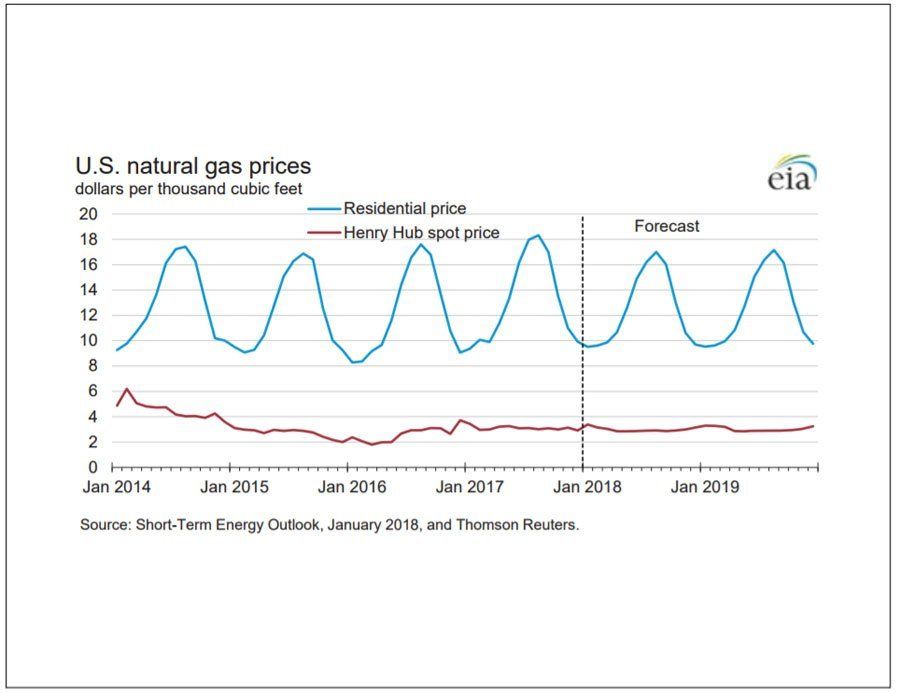

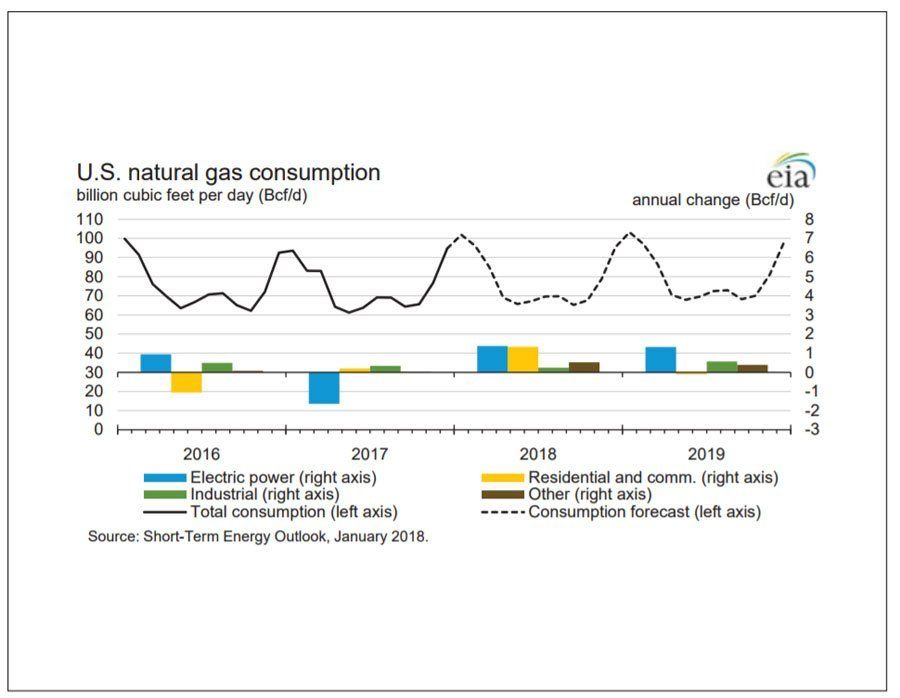

The STEO noted Henry Hub spot prices averaged $2.99 MMBtu in 2017, up 47 cents/MMBtu from a 17-year low in 2016. Henry Hub natural gas spot prices are forecast to average $2.88/MMBtu in 2018 and $2.92/MMBtu in 2019. Prices are expected to decline slightly from 2017 levels based on strong expected production growth, which EIA forecasts will meet growing domestic consumption and exports

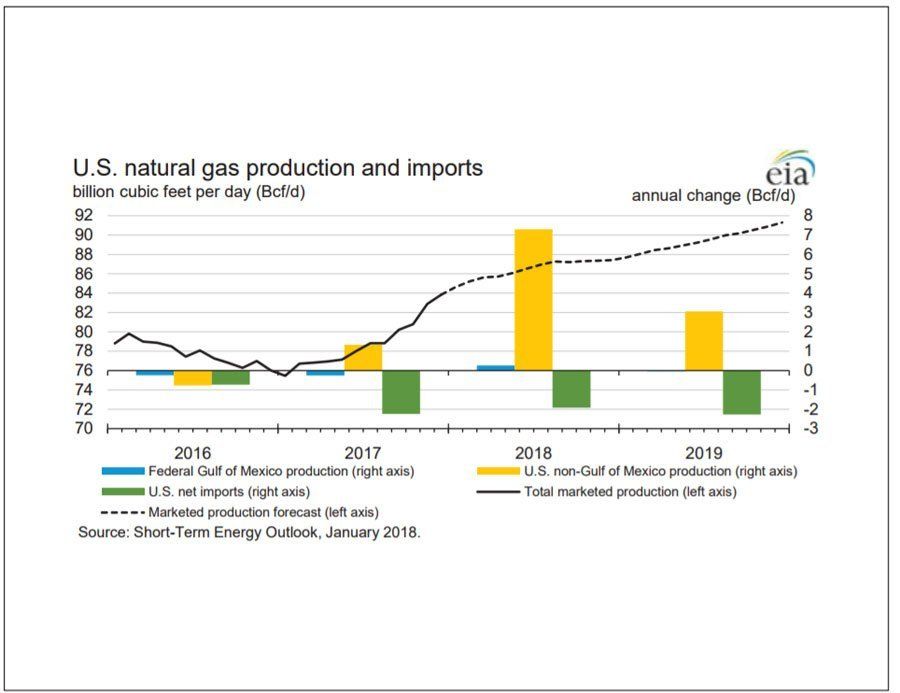

EIA expects dry natural gas production to rise by 6.9 Bcf/d (9.3%) in 2018 and by 2.6 Bcf/d (3.2%) in 2019. If achieved, the forecast 6.9 Bcf/d increase in 2018 would be the highest on record. Growth is expected to be concentrated in Appalachia’s Marcellus and Utica regions, along with the Permian Basin region. Much of the expected increase in natural gas production is the result of increasing pipeline takeaway capacity out of the Appalachia producing region to end-use markets. The greater pipeline connectivity contributes to higher wellhead natural gas prices for producers and is expected to encourage production growth.

Receive the most important LNG headlines in your email inbox each business day. Just sign up for our FREE LNG Headline Daily Newsletter.

Sign Up Here.