Shell LNG Outlook 2021

Global LNG demand expected to almost double by 2040

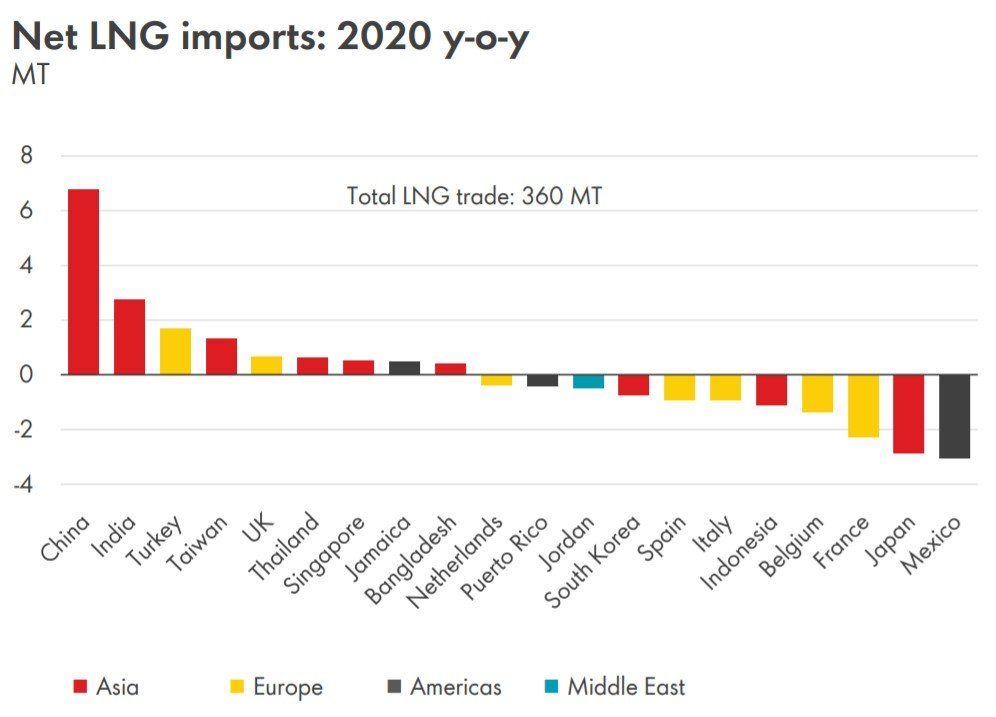

The Shell LNG Outlook 2021 released today finds that global demand for LNG in 2020 increased to 360 million tonnes from 358 million tonnes in 2019. Shell expects global LNG demand to hit 700 million tonnes by 2040. Asia is expected to drive nearly 75% of the growth as domestic gas production declines and LNG substitutes higher emission energy sources.

The Shell LNG Outlook 2021 noted China and India led the recovery in demand for LNG following the outbreak of the pandemic. China increased its LNG imports by 7 million tonnes to 67 million tonnes, an 11% increase for 2020. India increased imports by 11% in 2020 as it took advantage of lower-priced LNG to supplement its domestic gas production. Importers Japan and South Korea saw imports drop by 4% and 2% respectively in 2020.

Demand in Europe, alongside flexible US supply, helped to balance the global LNG market in the first half of 2020. However, supply outages in other basins, structural constraints, and extreme weather later in the year resulted in higher prices.

The COVID-19 pandemic also affected future supply investment in 2020 Only 3 million tonnes of new supply was announced in 2020. An anticipated 60 million tonnes was expected in 2020.

As demand grows Shell expects a supply-demand gap to open in the middle of the current decade with less new production coming on-stream than previously projected. The Shell LNG Outlook 2021 PDF report can be downloaded

here.

Key Findings By Region:

United States

Total liquefaction capacity – 74 MTPA

10 new LNG export projects came online in 2020. Cameron T2-3, Corpus Christi T3, Freeport T3, Elba Island T6-10

2020 - Total exports: 50 MTPA

2040 - Expected to grow to: 144 MTPA – 188% growth

China

2020 - Total imported: 67 MTPA

2040 - Expected to grow to: 130 MTPA – 94% growth

Gas outlook 2040 – Expected to grow to: 665 BCMA – 111% increase

South Asia

2020 - Total imported: 39 MTPA

India 27 MTPA, Pakistan 8.1 MTPA, Bangladesh 4.3 MTPA

2040 - Expected to grow to: 122 MTPA – 213% growth

Gas outlook 2040 – Expected to grow to: 216 BCMA – 78% increase

Europe

2020 - Total imported: 84 MTPA

2040 - Expected to grow to: 90 MTPA – 7% growth

Gas outlook 2040 – Expected to decline to: 495 BCMA – 3% decline

Japan

2020 - Total imported: 75 MTPA

2040 - Expected to drop to: 64 MTPA – 15% decline

Gas outlook 2040 - Expected to decline to: 85 BCMA – 20% decline

South East Asia

2020 - Total imported: 15 MTPA

2040 - Expected to grow to: 98 MTPA – 553% growth

Expected new markets – Philippines and Vietnam

Gas outlook 2040 – Expected to grow to: 238 BCMA – 79% increase

Australia

Total liquefaction capacity – 87.8 MTPA

2020 - Total exports: 81 MTPA

2040 - Expected to decline to: 78 MTPA – decline by 4%

Russia

Second largest gas exporter (pipeline and LNG)

Largest supplier of pipeline gas Europe

Total liquefaction capacity – 28 MTPA

2020 - Total exports: 32 MTPA

2040 - Expected to grow to: 97 MTPA – 200% growth

South America

2020 - Total imported: 7 MTPA

2040 - Expected to grow to: 22 MTPA – 214% growth

Gas outlook 2040 – Expected to grow to: 193 BCMA – 43% increase

Africa

Total liquefaction capacity – 66 MTPA

2020 - Total exports: 43 MTPA

2040 - Expected to grow to: 126 MTPA – 193% growth

Middle East

Total liquefaction capacity – 95 MTPA

2020 - Total exported: 97 MTPA

2040 - Expected to grow to: 141 MTPA – 45% growth

South Korea

2020 - Total imported: 40 MTPA

2040 - Expected to grow to: 47 MTPA – 17% growth

Gas outlook 2040 – Expected to grow to: 71 BCMA – 31% growth

Receive the most important LNG headlines in your email inbox each business day. Just sign up for our FREE LNG Headline Daily Newsletter.

Sign Up Here.